November/December 2017

Using Donor Advised Funds to Fulfill The Philanthropists Need to Give Back To set up a DAF, you would make a gift to a sponsoring 501(c)3 organization which will retain the donated funds for future distributions, but you can immediately receive the benefit of an income tax deduction for the gift. As an added benefit, you are able to make recommendations as to which charitable organizations should receive the donated funds. It is important to note that you cannot force the sponsoring organization to make distributions to a particular charity, so if you are interested in setting up a DAF, you will want to make sure you pick an organization whose goals are in line with yours and who has a solid reputation for administering these types of funds.One good option would be to set up a DAF through a local community foundation. Community foundations are dedicated to using funds received from individuals and business to improve the lives of people in the community. By setting up a DAF through a community foundation, you get the benefit of working with professionals who are skilled at running a charitable organization. In addition, those same professionals are immersed in the community and therefore are very familiar with the community’s needs and can advise you on how to make the biggest impact with your donation. DAFs can be a good option for philanthropists whose financial situation changes from year to year because contributions can be made at any time, in any amount or not at all. In addition, DAFs can be set up quickly and the cost to administer the funds are typically minimal. DAFs are a great tool for those with charitable intentions on any level.

Charitable IRA gifts Donors over the age of 70 can make tax-free charitable distributions of up to $100,000 directly from their IRAs each year. Unlike a direct charitable contribution which is subject to itemized deductions, the donation from your IRA is not taxable.Donors who have reached age 70 can direct amounts (subject to the $100,000 limit) to charity which can satisfy their RMD (required minimum distribution) as long as the following requirements are met:

• The donor is at least age 70 at the time the gift is made.

• The charitable gift is made directly from an IRA to the charity.

• Individuals can make as many gifts in any amount to as many charities as desired as long as the total does not exceed $100,000 per year.

• The gift cannot be made in exchange for a charitable gift annuity or to a charitable remainder trust.

• The gift cannot be made to a private foundation, donor-advised fund, or supporting organization (as described in IRC Section 509(a)(3)).

——————————————————————————————————————————————————————————

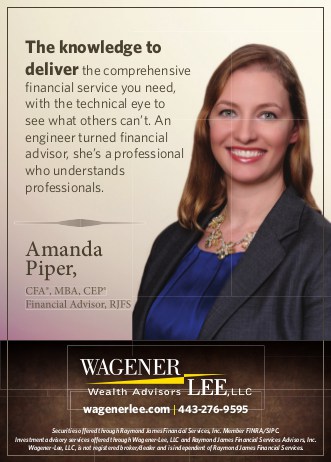

Amanda R. Piper, CFA, MBA, CEP Financial Advisor, RJFS Chief Investment Officer, In 2015, Amanda earned the Chartered Financial Analyst® (CFA) credential, considered by many to be the most respected and recognized investment management designation in the world.

———————————————————————————————————————————

Wagener-Lee, LLC5950 Symphony Woods Road, Suite 412Columbia, MD 20144

phone: 443-276-9595 email: [email protected] www.WagenerLee.com

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services offered through Wagener-Lee, LLC and Raymond James Financial Services Advisors, Inc. Wagener-Lee, LLC is not a registered broker/dealer and is independent of Raymond James Financial Services.Investing involves risk and investors may incur a profit or a loss. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.Jennifer C. McManus, Attorney Davis, Agnor, Rapaport and Skalney10211 Wincopin Circle, Suite 600Columbia, MD 21044Phone: 410-995-5800Email: [email protected] Jennifer C. McManus and Davis, Agnor, Rapaport, and Skalny are not affiliated with Raymond James.