Resolution: Start building for retirement.

Retirement planning: It’s never too early to start.

Simple changes can add up to a more secure future.

By Barbara Pash

DECEMBER 2015/JANUARY 2016

We’ve all seen the ads, or heard the question: “What’s your number?” referring to the imposing sums

You can’t start planning for retirement too early. Most people wait, usually five or so years before the big “R” looms on the horizon. By then, they may not have time to accumulate the savings, investments and tax strategies that will allow for the lifestyle they want.

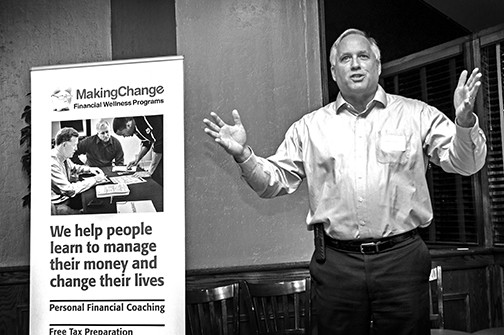

“The rule of thumb is a 4 percent withdrawal rate per year upon retirement, balanced by an equal percent of growth to account for inflation,” said Mike Couch, executive director of MakingChange, a nonprofit whose goal is to help Howard County citizens achieve financial stability. That means a substantial chunk of change in the bank.

Your working years are, in the jargon, the “accumulation phase.” As soon as you stop working and collecting a paycheck, you’re in the “withdrawal phase.” Some of your living expenses will be covered by Social Security and a pension or 401K; the rest, by your savings and investments.

“The question is, how much do you need to retire? That depends on your living expenses,” said Couch, a certified financial planner who runs the nonprofit from his home in Ellicott City.

To figure that out, MakingChange offers financial seminars, one-on-one financial counseling and tax preparation. Its services are held in libraries and county agencies and are usually free. Some of its clients are low-income; some, middle-income; and still others, divorced women and single mothers.

Even so, there are activities they can do to prepare for retirement, Couch said. Among them: cutting back on expenses and saving the difference; if they are employed, investing in the company’s 401K; having a good credit rating and taking advantage of applicable tax rules.

Lyn Dippel sees a different type of client. As president of FAI Wealth Management, in Columbia, her clients tend to be in their 50s, are thinking of retiring in five to 10 years and have at least $500,000 in savings and investments.

With these clients, she says, “We run through different scenarios. They may be able to retire comfortably but can’t afford that second home, or they can travel but not as extensively as they anticipated,” says Dippel, who takes into account a client’s investments, savings, pension, insurance, taxes, Social Security income and medical expenses.

Dippel suggests four simple strategies for women who are planning retirement: Start thinking about it as soon as possible, assessing how much income you’ll need when you do; in your 50s and 60s, consider long-term care insurance and how that aspect of your life will be handled; make sure your investment portfolio is tied to your retirement goals, both in timing and risk; and consult an expert about your taxes.

The latter is especially important for the self-employed and small business owners. “There are tax strategies that benefit you,” she said. “Take advantage of them.”